6. How to Calculate the True Cost of Crypto Mining Hosting in the UK

When diving into the world of cryptocurrency mining hosting in the UK, it’s essential to grasp the concept of the “true cost.” Beyond the surface-level expenses of renting space or power, a myriad of other factors contribute to the overall expenditure. From the volatility of electricity prices to the efficiency of your mining rig, understanding this holistic cost is what enables miners and investors to make informed decisions. Bitcoin (BTC), Ethereum (ETH), and emerging altcoins like Dogecoin (DOG) each have unique mining requirements, necessitating a tailored approach for mining farm operators and individual miners alike.

Electricity remains the heavyweight champion of mining costs. The UK’s energy market is notoriously complex and, at times, expensive compared to more mining-friendly regions. So, estimating the energy consumption of your mining rig, factoring in cooling systems and transmission losses, is the first critical step. For example, Bitcoin mining rigs such as the Antminer series consume between 1,200 to 3,000 watts, depending on the model, while Ethereum-focused GPU rigs vary widely based on configuration. The efficiency of these machines directly impacts profitability, which must be carefully weighed against fluctuating energy tariffs in different regions of the UK.

Hosting providers often bundle various services—physical security, insurance, equipment maintenance, and network connectivity—into their fees. While these additional services relieve miners of technical headaches, their costs can add up significantly and should be transparently accounted for. For instance, miners must be wary of “hidden charges” such as cross-border VAT implications if the equipment or service provider is located outside the UK but serving UK clients. This multifaceted financial landscape demands that miners scrutinize every clause in hosting agreements.

Another dimension often overlooked is the depreciation of mining hardware. Bitcoin mining rigs and Ethereum miners do not retain their value indefinitely; new models with better hashing power and energy efficiency usher older equipment into obsolescence rapidly. This depreciation factor, combined with the pace of technological innovation, imposes a diminishing return on hardware investments over months or years. Knowing when to upgrade or retire mining rigs is key to maintaining a profitable operation amidst the intensifying competition.

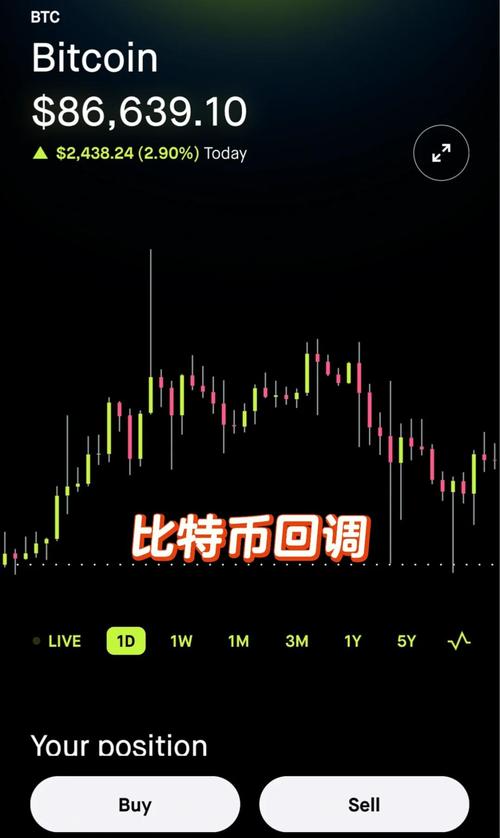

Network conditions and mining difficulty also dictate economic viability. As Bitcoin, Ethereum, or Dogecoin networks adjust their mining difficulty to maintain block time consistency, the amount of computational work required increases, effectively raising the cost of each mined coin. Miners must constantly monitor difficulty trends and price movements across cryptocurrency exchanges. A profitable mining hosting service in one quarter could become a loss leader in the next without agile financial and operational strategies.

Environmental regulations in the UK also impact hosting choices. With increased governmental scrutiny on energy-intensive activities, sustainable and renewable energy options are becoming not only preferable but, in some cases, mandatory for hosting facilities. Crypto mining farms that leverage green energy sources can reduce regulatory risk and appeal to eco-conscious investors and customers. This shift is accelerating innovation in miner design and hosting infrastructure, blending profitability with responsibility.

Berthing mining machines in a hosting provider’s data center can offer unmatched benefits — physical security, consistent power supply, and professional maintenance — but they come at premiums that savvy miners must quantify rigorously. Hosting pricing structures vary widely: some charge per kilowatt-hour consumed, others take a flat monthly rental per rig, factoring in cooling and bandwidth costs. Miners should request detailed breakdowns and compare multiple providers to identify the optimized setup for their coin of choice — be it BTC, ETH, DOG, or emerging altcoins with unique algorithmic profiles.

Lastly, an intangible yet pivotal cost relates to liquidity and capital lock-up. Mining hardware and hosting contracts may require upfront capital expenditures and long-term commitments, reducing financial flexibility. Moreover, cryptocurrency markets’ notorious volatility can suddenly erode expected returns. Many miners integrate real-time monitoring systems and exchange APIs within their operations to pivot rapidly, switching hashing power allocation across coins or liquidating positions when profitability wanes. This dynamic approach minimizes exposure and enhances return on investment.

In essence, calculating the true cost of crypto mining hosting in the UK transcends mere energy bills and rental fees. It encompasses a sophisticated web of hardware considerations, market dynamics, regulatory frameworks, and operational nuances. Miners committed to thriving in this competitive space must embrace this complexity, leveraging data-driven insights and strategic partnerships to harness the full potential of Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies through efficient mining rig management and hosting solutions.

Unveiling hidden fees! This guide dissects UK crypto mining hosting, beyond kWh costs. Factor in cooling, security, latency & uptime guarantees for accurate profitability projections. Essential reading before investing!