Is Mining Machine Hosting Worth It? Analyzing Expected Return Rates

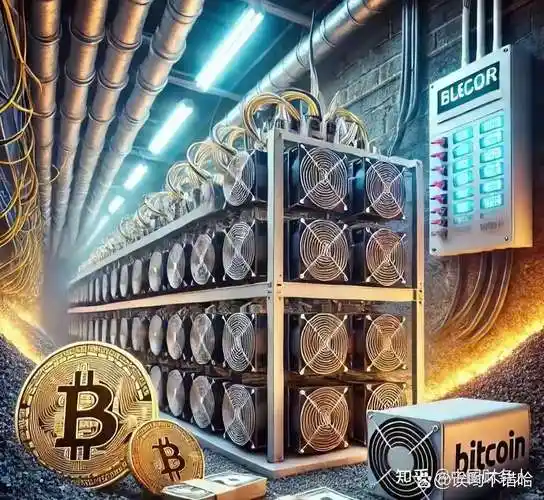

Picture this: You’re knee-deep in the crypto game, dreaming of Bitcoin riches. You’ve got the hardware – the roaring, power-hungry mining rig. But where do you stash it? Your apartment? Good luck explaining that electric bill to your landlord! This brings us to the burning question: **Is mining machine hosting truly worth the investment?** Let’s delve into the nitty-gritty of expected return rates and see if it’s a gold rush or just a fool’s errand.

The core of the debate lies in understanding the economics of mining. You’re essentially competing to solve complex cryptographic puzzles, and the first one to crack it gets rewarded with new coins. **The higher your hash rate (computing power), the better your chances.** But hash rate doesn’t come cheap. You need powerful machines, and those machines guzzle electricity. According to a recent report by the Cambridge Centre for Alternative Finance (CCAF) in 2025, Bitcoin’s annual electricity consumption now rivals that of entire nations.

Here’s where hosting enters the picture. These facilities offer climate-controlled environments, stable power grids, and expert technical support, all for a fee. Think of it as renting space in a data center, but specifically designed for mining. But is it cheaper than running your own operation? That depends.

**Theory: Understanding ROI** Return on Investment (ROI) is the golden metric. To calculate it for mining machine hosting, you need to factor in several things: the cost of the mining machine itself, the hosting fees (usually a monthly rate based on power consumption), the difficulty of the mining algorithm, the price of the cryptocurrency you’re mining, and any potential maintenance costs. Don’t forget to account for the inevitable depreciation of your hardware. It’s like buying a car – its value starts plummeting the moment you drive it off the lot.

**Case: The Bitcoin Boom (and Bust?) Scenario** Let’s say you invested in a high-end Bitcoin miner, an Antminer S21, costing around $10,000. Hosting fees are $150 per month. If Bitcoin’s price is soaring, your ROI could be impressive. However, if the price tanks (think of the crypto winter of 2022), you could be bleeding money. Furthermore, increased mining difficulty reduces your chances of solving blocks and earning rewards, directly impacting your profitability. You’re playing a game of chance with complex math.

Ethash, the algorithm behind Ethereum’s Proof-of-Work (PoW) consensus mechanism, once made GPU mining a lucrative option, but the Merge (Ethereum’s transition to Proof-of-Stake) changed everything. Now, miners are looking towards other cryptocurrencies to mine. Dogecoin, Litecoin, and other altcoins have seen a surge in mining activity as miners scramble to repurpose their hardware. While these coins may seem promising, their market volatility is often even greater than Bitcoin’s, making profitability even more unpredictable. Many have tried to find the next big thing; some even try to revive old favorites like Dogecoin, dreaming of similar price jumps. It’s a gamble, plain and simple.

**Theory: Location, Location, Location!** Just like in real estate, location matters in mining. Hosting facilities in regions with cheap electricity (like parts of China before the crackdown, or Iceland) can significantly boost your ROI. Cheaper power means lower operating costs, which directly translates to higher profits. But it’s not just about price; you also need a stable and reliable power grid. Imagine your mining rig going offline during a crucial mining period due to a power outage. Ouch!

**Case: Iceland’s Geothermal Advantage** Iceland, with its abundant geothermal energy, has become a popular destination for mining operations. Facilities there can offer significantly lower electricity rates compared to other parts of the world. However, even in Iceland, miners need to consider factors like cooling efficiency (climate control is still necessary) and the overall reliability of the infrastructure. The cheaper electricity helps you mine like a boss.

**Key Takeaways: Due Diligence is Paramount.** Before jumping into mining machine hosting, do your homework. Research different hosting providers, compare their rates and services, and read reviews. Consider the cryptocurrency you’re planning to mine, its market volatility, and the current mining difficulty. Finally, **calculate your potential ROI based on realistic assumptions**, not just wild speculation. Remember, in the crypto world, promises of guaranteed returns are often too good to be true.

Mining cryptocurrencies is a cutthroat business. Like panning for gold in the Yukon, the pickings can be slim and the competition fierce. **Hosting can make the process more manageable, but it doesn’t guarantee profits.** The smart miner is one who understands the risks, does their research, and approaches the endeavor with a healthy dose of skepticism. Now, go forth and may your hashes be ever in your favor!

**Naomi Klein**, a renowned social activist and author, is known for her incisive critiques of corporate globalization, ecological crises, and rising authoritarianism. She currently serves as the **Gloria Steinem Chair in Media, Culture and Feminist Studies at Rutgers University**.

Her groundbreaking work includes “No Logo,” “The Shock Doctrine,” and “This Changes Everything: Capitalism vs. The Climate.” She is the recipient of numerous awards, including the **Hilary Weston Writers’ Trust Prize for Nonfiction** and an **Honorary Doctorate from the University of King’s College**.

Klein holds a **Bachelor of Arts degree from the University of Toronto** and is a prominent voice in movements for social and environmental justice.

You may not expect how brutal liquidation can be when Bitcoin slides below certain price points; I’ve seen people lose stacks overnight, which is why I always scream about setting alerts and cutting losses early rather than holding hope.

The Bitcoin to RMB price can be a bit of a rollercoaster, but once you get the hang of tracking it, it’s easier to make smart moves.

To be honest, many newbies underestimate the importance of Bitcoin’s fixed supply; it’s the whole reason why it’s holding value over time.

It’s fascinating how Bitcoin resonance ties into Elliott Wave theory, making it essential for anyone serious about technical analysis in trading.

The customer service team in 2025 actually understands crypto. Really helpful and insightful.

Coinbase’s advanced fraud detection tech caught suspicious login attempts immediately, which made me trust them even more when purchasing Bitcoin.

The risk mitigation tools on this P2P Bitcoin platform, like 2FA and timely alerts, make me feel confident every trade day.

Honestly, you wouldn’t expect this much of an impact from power optimization, but these guys nailed it with their US hosting.

Staking rewards from 2025 machines add extra layers to traditional mining yields.

Bit-er Dividend Coin’s system keeps rewarding investors month after month – that’s real value in 2025.

To be honest, trading Bitcoin feels like a rollercoaster ride sometimes.

Storing 100 bitcoins can be nerve-wracking; using vault apps with time-delayed withdrawals adds an extra layer of protection in case your account is compromised.

Dealing with Bitcoin flow pools feels like decoding the secret language of crypto markets.

The green Bitcoin mining hosting price is pretty cheap, considering the cost of energy-intensive mining setups and the hassle of cooling systems.

To be honest, you may not expect the affordability of European compliant mining farm hosting in 2025, but it’s budget-friendly with perks like free upgrades that add real value.

Bitcoin’s fees depend heavily on transaction size and speed preference, so plan accordingly.

I personally think 2025 will surprise us with Bitcoin’s resilience, so buy in with confidence.

Bitcoin node URLs make peer-to-peer network interactions way more reliable imo.

I’ve been using this crypto mining hosting since 2025, and it’s a game-changer.

I personally recommend keeping track of wallet activity as it might indirectly signal lost Bitcoin, especially when addresses go cold for ages.

The 2025 mining hosting process is straightforward and efficient. I’m happy I made the switch; I’m seeing a noticeable increase in profitability.

I’ve tried many miners, and this one balances performance and energy use better than others, meaning my hash rates are up without insane power bills.

Honestly, Bitcoin price benchmarks come from combined data of transaction volumes, market sentiment, news cycles, and technical resistance levels, making it complex yet fascinating.

Bitcoin’s correlation with inflation is driving bullish bets from institutional investors, pushing prices up in 2025.

In the crypto mining community, Nvidia’s dominance is clear—top-tier hardware that’s optimized to maximize Bitcoin yields and sustain long-term operations.

Bitcoin’s weekly volume profile helped me map key zones where price consolidates; recognizing these gave me a big advantage when setting stops or targets.

I personally recommend beginners get familiar with Bitcoin trends from 2025 because this year’s surge is setting records for wealth generation unmatched by traditional finance.

After learning about Bitcoin’s origin, I appreciate how it empowers users by putting financial control back into their hands.

Honestly, the Kaspa rig I snagged in Germany exceeded expectations; you may not think it’s worth it, but the profits are real.

Main thing is proving you’re legit; they don’t want sketchy operations in their data centers.

I personally recommend keeping an eye on user feedback regarding sell times before choosing your Bitcoin seller platform to avoid unnecessary delays.

Not gonna lie, Bitcoin 86 charts made me rethink my strategy and helped me avoid some decent-sized losses last quarter.

s guide is invaluable for anyone serious about Bitcoin mining; it saved me countless hours and maximized my returns to an impressive 2025.

I personally believe 2025 will see a resurgence in GPU mining for niche altcoins; ASICs can’t mine everything, you see.

From my experience, Bitcoin’s correction was triggered by sudden capital rotation to altcoins and some profit-taking by early adopters. If you time the entry right after these dips, you can maximize your upside in subsequent waves.

The user interface on this mining setup is intuitive; it’s helped me monitor hash rates in real-time, optimizing my strategy for better 2025 outcomes.

Fact is, Bitcoin’s not vanished because it stands for more than currency—it’s a cultural and tech movement that’s hard to suppress globally.

I personally recommend mining history fans to dig into early Bitcoin methods—it’s a brilliant case study of decentralized systems created by ordinary folks.