High-Demand ASIC Miners for Profitable Altcoin Operations

The relentless hum of ASIC miners, a symphony of silicon and electricity, echoes across the global landscape, a testament to the enduring allure of cryptocurrency mining. While Bitcoin (BTC) often dominates the headlines, a vibrant ecosystem of altcoins beckons, promising potentially lucrative opportunities for those willing to venture beyond the well-trodden path. High-demand ASIC miners are not merely machines; they are specialized tools, meticulously engineered to extract value from the digital ether, transforming electricity into cryptographic rewards.

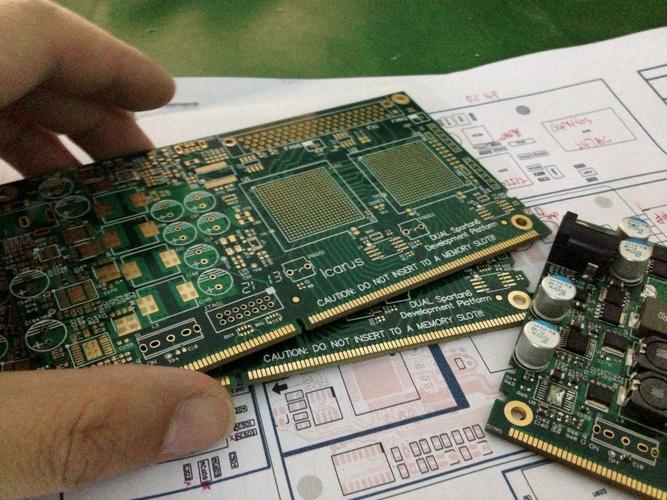

The key to unlocking this potential lies in selecting the right ASIC miner for the right altcoin. Each cryptocurrency boasts its own unique algorithm, a mathematical puzzle that miners must solve to validate transactions and earn new coins. Bitcoin, for example, relies on the SHA-256 algorithm, while other altcoins employ algorithms like Scrypt, Ethash (primarily for Ethereum’s historical proof-of-work phase), and various custom variations. An ASIC miner optimized for one algorithm will perform abysmally on another. Thus, meticulous research is paramount. Consider factors such as the miner’s hash rate (its computational power), power consumption (a critical determinant of profitability), and the overall difficulty of the target altcoin’s network. A high hash rate combined with efficient power usage translates to a higher profit margin.

Beyond the technical specifications, a comprehensive understanding of the altcoin market is essential. Not all altcoins are created equal. Some are fleeting fads, destined to fade into obscurity, while others possess genuine utility and the potential for long-term growth. Investigating the coin’s underlying technology, development team, community support, and real-world applications is crucial before investing in dedicated ASIC miners. A promising altcoin with a strong use case and active community provides a more stable foundation for mining operations, reducing the risk of investing in hardware that becomes obsolete due to a lack of profitability. Furthermore, factor in the liquidity of the altcoin on various cryptocurrency exchanges. Ease of conversion to BTC or fiat currency is paramount for realizing profits.

The allure of altcoin mining stems from the potential for higher returns compared to Bitcoin mining. This is often due to lower mining difficulty and a smaller pool of competing miners in the early stages of a project. However, this advantage is often temporary. As an altcoin gains popularity, its mining difficulty tends to increase, requiring more powerful hardware to maintain profitability. This dynamic underscores the importance of continuously monitoring the market and adapting one’s mining strategy accordingly. Smart miners often diversify their operations, spreading their resources across multiple altcoins to mitigate risk and capitalize on emerging opportunities. The dance between hash rate, power consumption, mining difficulty, and altcoin price requires constant vigilance and adaptation.

For many, the logistics of operating and maintaining ASIC miners can be daunting. This is where mining machine hosting services come into play. These services provide the infrastructure, including power, cooling, and security, necessary to house and operate mining equipment. Hosting can be particularly attractive for individuals and smaller operations that lack the technical expertise or resources to build and maintain their own mining facilities. However, it’s crucial to select a reputable hosting provider with a proven track record. Factors to consider include the provider’s uptime, power costs, security measures, and customer support. Carefully evaluate the terms of service and ensure that the hosting agreement aligns with your mining goals and risk tolerance.

In conclusion, profitable altcoin operations with high-demand ASIC miners require a blend of technical expertise, market awareness, and strategic decision-making. It’s not merely about acquiring the most powerful hardware; it’s about understanding the nuances of different altcoins, navigating the complexities of mining algorithms, and adapting to the ever-evolving landscape of the cryptocurrency market. Whether you choose to build your own mining farm or leverage the services of a hosting provider, a well-informed and proactive approach is essential for success. The hum of the ASIC miners is a constant reminder of the potential rewards, but also the inherent risks, that lie within the fascinating world of cryptocurrency mining.

This article explores the surge in ASIC miners tailored for altcoins, highlighting innovative models that boost efficiency, reduce energy consumption, and maximize profitability. It also examines market trends, investment risks, and emerging cryptocurrencies benefiting from specialized mining hardware.